How to earn frequent flyer points

Of course, still the most conventional way to earn points is taking flights with airline and the partner airlines of that airline and booking them whilst you are logged into your frequent flyer account or by providing your membership number when booking with eligible partners.

These days however you don’t even have to fly often to rack up a considerable points balance wit with many airlines partnering with hundreds of other partners meaning points can be earned on everything including everyday shopping, accommodation, car hire, transportation, tours, and other transportation means. Further, your points balance can be significantly compounded through credit cards and financial services

Earning points through Flights

In a nutshell the most conventional and most common way to earn points is when purchasing eligeable flights with the airine and its partners for which belong to your frequent flyer program. A number of factors will determine the number of points earned, but these are generally multiplied with higher fare categories and cabin classes and of course your program’s frequent flyer status tier.

Established airlines such as Qantas offer a handy points calculator on their website that can give you a guide to how many points your next flight might earn or alternatively how much you might need to redeem for a desired future flight or upgrade. When making a booking with the airline make sure to double check you are signed into your account or with partner airlines that you provide your number when checking out to save any hassles or disappointment later. If unsure if the airline you are flying with is affiliated with your airline’s program it may be worth checking the drop-down list of eligible programs when checking out.

Credit Cards, Insurance and other Financial Products

Perhaps the most popular way to quickly compound points for some of the most common frequent flyer programs enrolled in by Australians is through credit cards. Most Australian banks offer frequent flyer themed award credit cards and other financial products that are linked with the either the Qantas Frequent Flyer Program or Virgin’s Velocity program which earn points when you do your everyday spending on the card.

Up to 1 point per dollar spent domestically and even more when overseas are common features of these cards but it pays to check your card’s exact earn rates which may change according to product category and have exclusions such as transactions to the ATO. Once you have initially linked your Qantas or Velocity or any other eligible frequent flyer account to your card you don’t have to do anything else with points usually being credited to your account at the end of each billing cycle.

Other cards may be attributed to the banks own reward program and earn points often at higher rates. These programs offer a wider range of options to redeem your points with one option being to manually transfer points at a pre-determined and usually lower exchange rate to another frequent flyer program which could include Qantas Frequent Flyer or Velocity. One advantage of using the banks own reward programs is that it is often possible to transfer your points to international carrier programs such as Singapore Airlines Kris Flyer giving you even more options to align with the airline of your choice.

When signing up to these cards it pays to take advantage of sign-up bonuses usually available to new customers which can often land customers bonuses between 30,000 and 150,000 points depending on card tier and minimum spend and other requirements been met or card fees being paid. By signing up for the occasional new credit card and managing spending responsibly you can quickly build up an impressive points balance and redeeming that luxury overseas business class quicker than you think!

Insurance is another way you can compound significant amounts of points especially when enrolled in the Qantas Frequent Flyer Program. Insurance is a necessary expense for most people with cars, home and whom travel. If you can find a policy that suits your needs at a competitive price, Qantas offers a range of insurances which like credit cards can offer significant sign-up bonuses and recurring points earn on the cost of the policy. For those travelling abroad Qantas’s Pre-Paid travel card may also worth considering and earns 1 point per dollar spent however it is worth keeping in mind certain credit cards may offer higher earn rates on international purchases and other perks such as no foreign currency conversion fees so it pays to check what is a better value proposition for your own circumstances.

Hotels, Car Hire and Other Partners

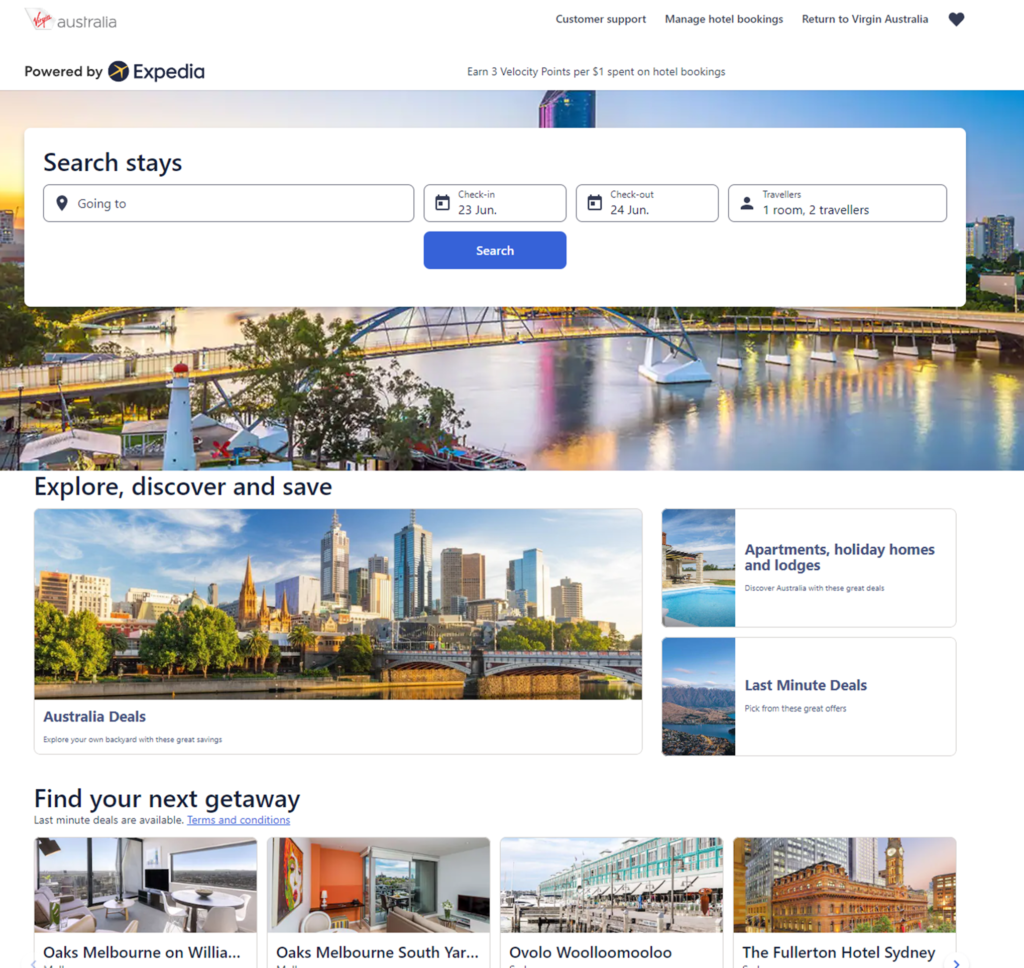

Another way to earn points is through the various airline’s travel partners on the ground or through their own business subsidiaries. For example, booking through Qantas Hotels or Virgin Australia Hotels will earn at least 3 points per dollar spent. Qantas Points Club members also earn an additional 25% bonus on points earned. Alternatively, booking with Airbnb and Luxury Escapes is another way to earn 1 point per dollar on accommodation. Flybuys customers can also book hotels and fligths through Flubuys Travel where you can earn flubuys points on the bookings and then transfer them to Velocity points at a later time.

Qantas members can also earn a point per dollar spent while car hire partners Avis and Hertz whilst Hertz, Europcar and Thrifty all offer points earning potential with Virgin. For Qantas customers, rideshare company Uber also opportunity to earn points. In a competitive market with cashback and other brand loyalty programs to be had on things such as car hire and hotels it does pay however to assess which avenues for rewards suits your circumstances best on these purchases. Whilst Qantas and Virgin are the two big earning opportunities for Australians many other airlines also offer similar opportunities to earn points as well.

Everyday spending

There are numerous ways that you can earn points for everyday spending such as on groceries, alcohol, fuel, and pharmaceuticals whereby points can be earned through Woolworths Rewards, BP fuel outlets and TerryWhite Chemist for Qantas whilst 7-11 and Coles and the Flybys network of retailers offers plenty of opportunities for Virgin example.

Points at often heavily boosted rates can be earned through the Qantas Shopping Portal and Virgin Velocity E-Store with over a 100 different online retailers. With strong competition coming from other banking programs and cash back on offer through programs such as CashRewards it pays to weigh up which programs and promotions offer the best value to you.

Purchasing points, family pooling and other points sharing arrangements

There are also several other ways to transfer or attain points for your airline’s frequent flyer account. One popular such way is through transferring from a family member or by purchasing points directly from airline which is a great feature if you are shy short of your dream flight redemption. Points can often be transferred from other loyalty programs as well who may be able to convert points into your own frequent flyer program account.

Where can you typically expend frequent flyer points?

Best Value points redemptions

Not all points are created equal in terms of redemption value

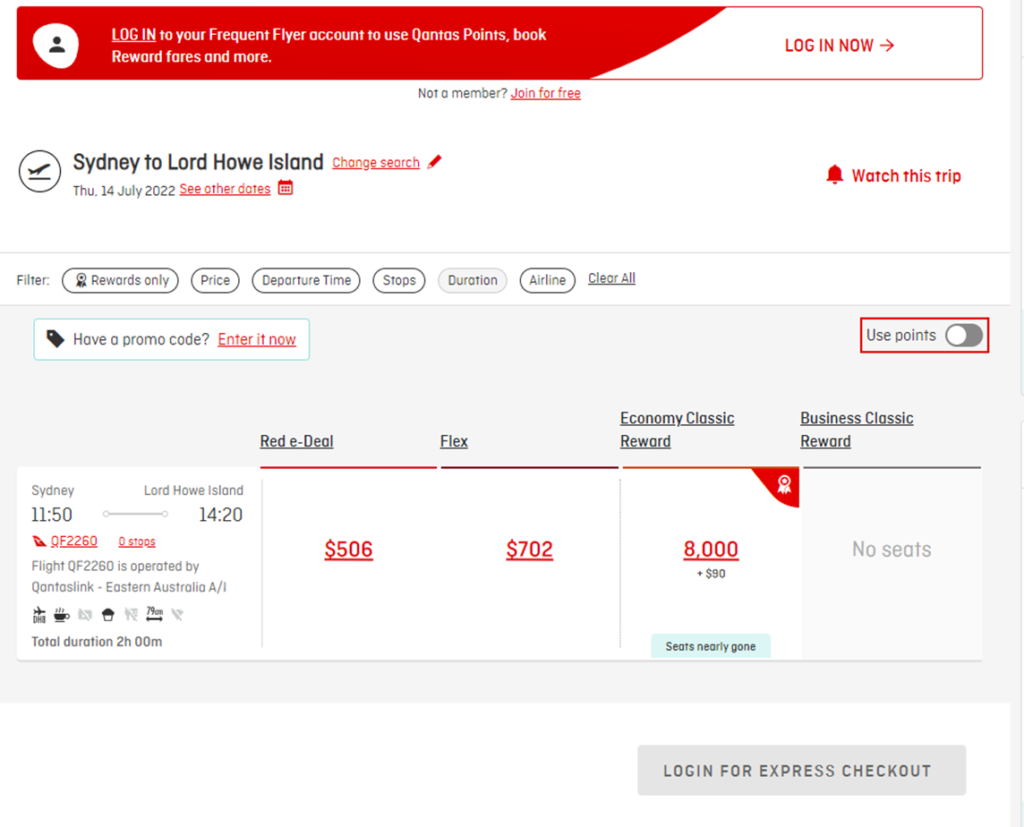

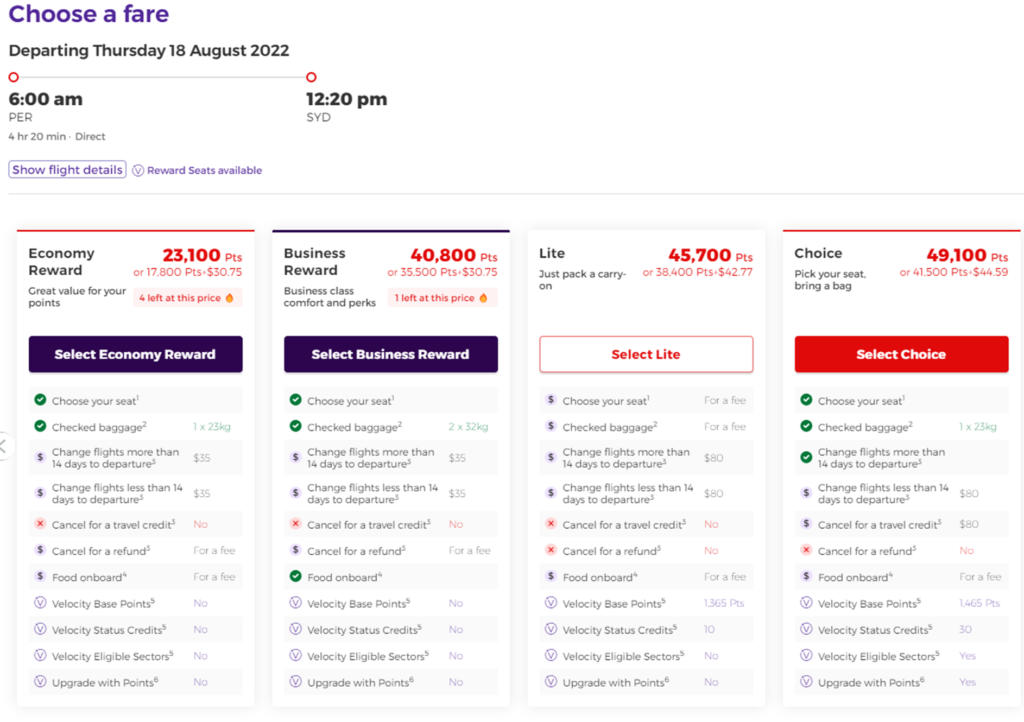

Your hard-earned frequent flyer points in our opinion are always best put to use for flight redemptions on the airline’s website. Whilst you can book ‘any seat’ in theory with many airlines it is far better to be flexible with your dates and routes and redeem a ‘rewards seat’ which maximize the monetary value of your points and won’t dent your points balance anywhere near that of a ‘any seat’ redemption.

For most airlines flight reward redemptions are not based on dynamic pricing but instead a miles table meaning that some routes with high competition and steep rarely reduced fares could be redeemed that are in the same miles bracket to high frequency and frequently discounted routes. On the flip side, availability of reward seats varies greatly and they can be reasonably difficult at times to find especially for business and first-class redemption on flagship international routes.

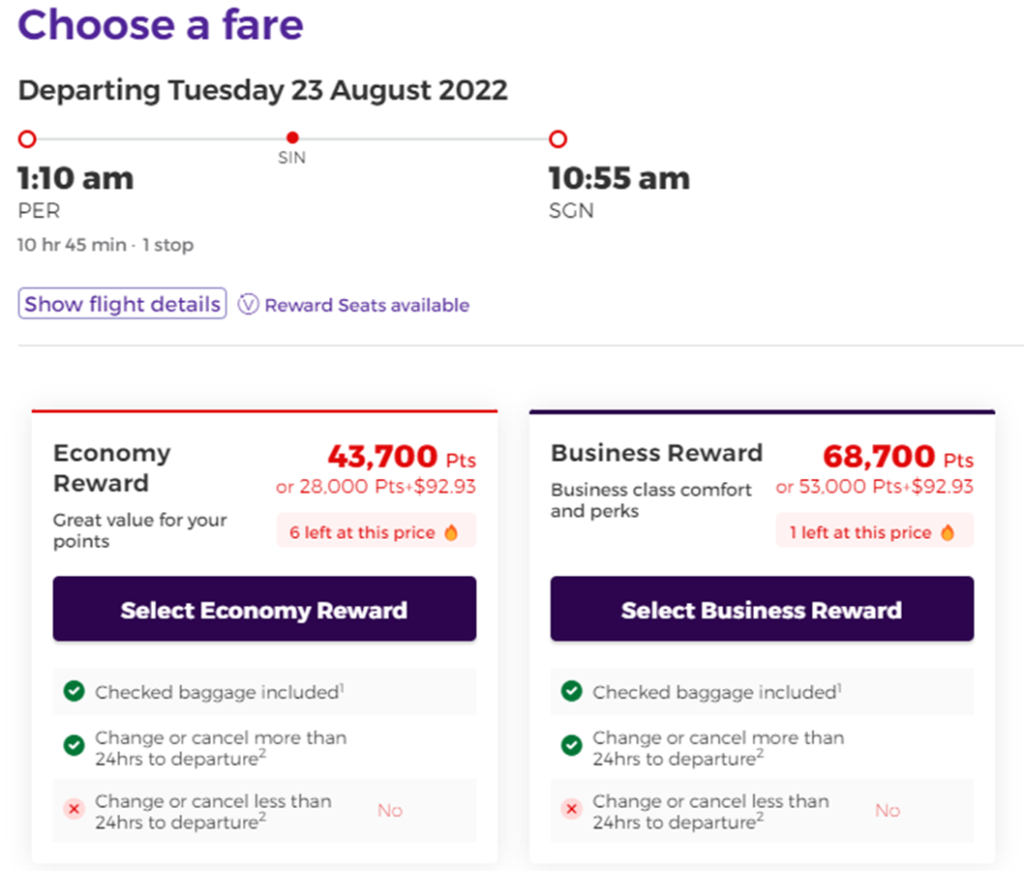

Best (outstanding) value: Business and First class reward flight redemptions (or upgrades)

In most cases the best bang for buck redemption opportunities generally are for business and first class rewards or upgrades where when paying cash the greatest cost deferential is apparent to that of an economy class seat. Once in the game for redeeming Business and First class flights the redemption value of your points travels even further once redeeming for longer haul international flights on popular carriers and busier routes.

Coming in at little over double the cost in points over an economy redemption for Business class these are excellent redemption opportunities as the cash price difference for Business is often 4-6 times that of economy! If you can afford the patience to build up that points balance redeeming a business or even first class overseas is going to be the holy grail of redemptions for most travelers!

To help find flight rewards ensure you tick ‘points’ when searching for flights and can also filter flights to see calendar months worth of reward availability. To compare the points price with the cash price you can toggle between the two to help ascertain how good a value your desired redemption might be. With any case with a reward seat, they may require patience and strategy to find, and they won’t entirely be free and require a co payment to cover taxes and surcharges which are usually less than $50 in Australia but can be significantly more especially for overseas premium class redemptions.

Second best (great) value: economy class reward flight redemptions

If you have a more modest points balance and are focused on redeeming reward flights more often opting to fly economy is still a great option as it will allow you to redeem more flights but in the long run you are less likely to maximize the value of your points not saving them up to redeem for business or first class flights. In other words if you don’t have enough points to fly business or need to use your points for more flights booking economy seats is the next best option. When booking economy class rewards look for routes that are less competitive and thus attract higher cash fares as they could cost the same amount of points as than flights that have a higher frequency of services and greater competition which therefore attract much lower cash fares which may not be worth expending points on. In most cases booking economy class rewards seats is still a far better use of points than for non flight redemptions such as hotels or online rewards stores.

Third best (average) value: hotel bookings and other travel services

Many airline frequent flyer programs will also offer the opportunity to redeem points for hotels through their own booking or partner portals. Whilst it is great to have another option to redeem your points using them for hotels is usually not going to garner as great value as for used with flights but the option is there nonetheless. For those who for whatever reason take flights infrequently redeeming points for hotels is still a better option than not ar all! For those who fly more than occasionally you might be better using the airline’s hotel portals to compound points on your bookings instead.

Fourth best (poor) value: online reward stores

Another way you can redeem points is for gift cards and other consumer goods or services through the airlines own rewards portal or store. Again we tend to stay clear of recommending these uses if you have points unless they are due to expire or you have no intentions to be in a position to fly whilst your points are still valid. If this is what you would like to use your points for though then we say why not!

To demonstrate the poor value of these redemptions an iPhone 13 513gb can be redeemed in the Qantas store for 325,040 points with a retail value of $1,869 whilst just 216,000 points and over 100,000 points to spare may be all it needs to redeem a Classic first class award seat from Sydney to New York worth over $12,000 cash!

Fifth best (bad) value: ‘any seat’ flight redemptions

Finally arguably the worst way to redeem your points is for an ‘any seat’ or other similarly named redemption opportunity offered by some airlines to redeem flights that have no reward availability. With airlines such as Qantas for example who offer this style of redemption you’ll find the value of your points correlates directly with the cash value of the flight ticket in question meaning you could easily be finding yourself redeeming up 10 times the rate of points to secure that flight than had it been available under a reward booking. Whilst we wouldn’t rule out going down this pathway in the case of an extreme emergency for all other scenarios it will pay off big time to be exercise patience and wait for the release of reward seats or otherwise simply book with cash

Our top tips for using frequent flyer points

Constantly keep a look out for reward seat release dates and book early especially for premium classes and popular routes

Unfortunately the ability to book reward flight seats shouldn’t be taken for granted. Understandably airlines have to find the right balance between making their flights available for revenue paying passengers and those flying on points redemptions. Therefore not every flight will have reward availability and the ones that do often have a limited amount of seats in each class up for grabs whilst upgrades if available may not be able to be actioned to last minute. Therefore to increase your chances of getting a reward seat it pays to be patient and flexible and look out early for flights when reward seats first become released. This is especially important for business or first class redemptions which are incredibly popular on popular long haul international routes. Sometimes airlines may also offer reward availability at the last minute if they expect flights not to be busy so it also pays to check closer to the departure day as well.

Devise a clear strategy on how you wish to earn and redeem points

Before embarking on a new campaign to build up your frequent flyer points balance its a good idea to devise a strategy on how you wish to earn and redeem points. It pays to brainstorm all the numerous ways you can earn points and choose carefully what partner programs you enroll in offer good value to you after which you can then modify your spending patterns accordingly whether that might be spending predominately with certain points earning retailers or credit cards.

When pursuing a strategy of a strategy of a constant pattern of signing up for new credit cards you’ll also want to be sure it doesn’t harm your credit rating. If credit card sign up bonuses are a part of your strategy thoroughly do your homework first and ensure your time big upcoming purchases to coincide with new sign up bonus spending requirements.

Once the points start coming in you also want to have a strategy of how you wish to redeem them. Some might prefer to build up a considerable balance over time to enjoy a long haul first class travel experience whilst others might prefer the convivence of having a constant stream of points available to book shorter economy class flights. Whatever approach you take is pays to be consistent.

Don’t always take up the temptation to use points and consider whether it is better paying cash

Having a sizeable frequent flyer points balance can be a very useful asset for both frequent flyers and leisure travelers alike and it pays to treat this balance with care and due diligence. It is therefore important to know that is isn’t always a great idea to redeem points for just any flight and you should know when the right time is to avoid the temptation of using points and simply paying cash instead. This is especially the case when economy class fares are on sale for a significant discount whereby the points redemption rate doesn’t decrease and you would be better to retain these points for a more considerably expensive cash fare.

Build up your airline status to help multiply earn rate

Another great way to build up your points balance is by ascending through the various status tiers in your airline’s program. The higher the status the higher earn rate you’ll typically enjoy on flight bookings with some of the top status tiers earning up to 2 times or more earn rate than base level members. If you are close to gaining a higher status level this is a great goal to set.

Constantly look out for other avenues to increase your points balance

Whilst we have already covered many of the numerous ways that you can increase your points balance it pays to keep a look out for constantly changing and new points earning opportunities. The airline industry is vary dynamic and its frequent flyer programs are always looking for new avenues for partnership so one product or service that doesn’t have points earning potential today might do in the future.

Summing Up

Earning and redeeming frequent flyer points has become a work of art for many although even for entry level frequent flyer members opportunities to earn and redeem your points has never been easier. With the right strategies and goals in place however you can really maximize your points earning potential and make the greatest mileage of there redemption power possible.